Since the beginning of 2014, the market has been moving upward. Yes, there were three small downdrafts along the way in January, April, and the most recent one that started at the end of July. But for the most part, the bullish run that started at the end of 2011 has continued in 2014.

Since the beginning of 2014, the market has been moving upward. Yes, there were three small downdrafts along the way in January, April, and the most recent one that started at the end of July. But for the most part, the bullish run that started at the end of 2011 has continued in 2014.

However, something is bothering me about the market in 2014, and this is why it should start to bother you too…

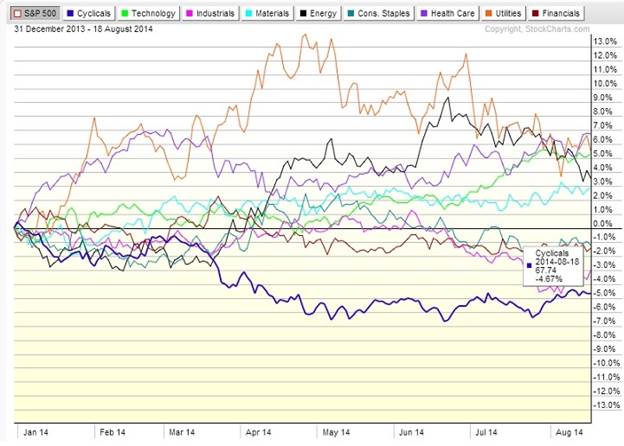

What is irking me is the fact that the Consumer Discretionary sector is the laggard among nine sector Standard & Poor’s depositary receipt exchange traded funds, or SPDR ETFs. The S&P 500, which is the benchmark index for the market, was up 6.68% so far this year as of August 18. Using the Consumer Discretionary Select Sector SPDR (XLY) as our index for the consumer discretionary or consumer cyclical sector, we see that the sector has only gained 2.01% for the year.

The top-performing sector for 2014 so far is the Healthcare sector with a gain of 13.44%, and it is followed closely by the Utilities sector with a gain of 12.11%. Healthcare and Utilities are not the sectors we normally see leading the way during a prolonged bull market. These two sectors, along with the consumer staples sector, are considered more defensive sectors.

Looking at the performance chart below, we see that four sectors have underperformed the S&P and five sectors have outperformed. Remember when you are viewing the chart that the benchmark is the S&P 500. The chart shows four sector SPDRs in negative territory, but they have all gained ground in 2014. Yet, the benchmark is up 6.68% so anything below that return is considered negative or lagging.

A few weeks ago in this space I wrote about the US economy and how it was on the rebound. The GDP is growing, the employment picture is improving dramatically, and consumer confidence is the highest it has been in over five years. If you believe in the theory of sector rotation, we could be looking at this period of economic expansion coming to an end…

The idea is that at the market peak, the sectors that lead the way are consumer discretionary, technology, and industrials. When the market has peaked, investors start rotating into sectors such as healthcare and utilities. The second part of the theory is an acknowledgment that the market is ahead of the economy, meaning that the market peaks a few months ahead of the economy.

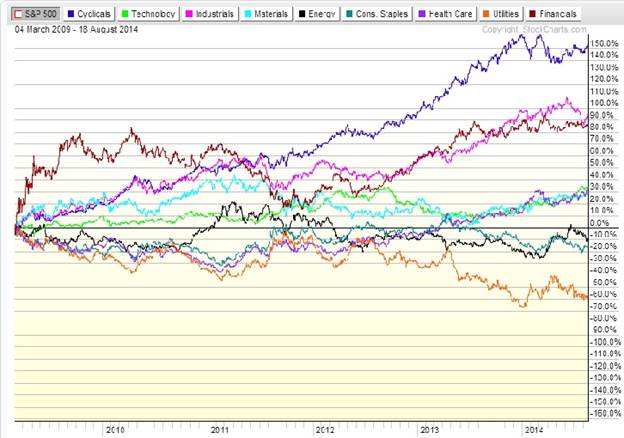

If we look at the same nine sectors in the chart above, but we go back to the market bottom in March 2009, we see that the three top performing sectors over the last five years are consumer discretionary (by a wide margin), industrials, and financials. The two worst performing sectors are utilities and consumer staples.

Seeing healthcare and utilities leading the way over the last eight months while consumer discretionary and industrials lag behind makes me wonder about the health of the market and the health of the economy.

If the consumer discretionary and industrial sectors should rebound over the next four months, I would feel a whole lot better about the market heading into 2015.